In the context that China stops exporting yellow phosphorus and global chip production activities recover positively, the business activities of Duc Giang Chemical Group (stock code DGC) are expected to benefit greatly.

lobal chip and semiconductor production is recovering positively, bringing with it the outlook for yellow phosphorus demand.

According to a recent assessment by Vietcap securities firm, the business activities of Duc Giang Chemical Joint Stock Company (stock code DGC – HoSE) will benefit greatly in the context that China no longer exports yellow phosphorus.

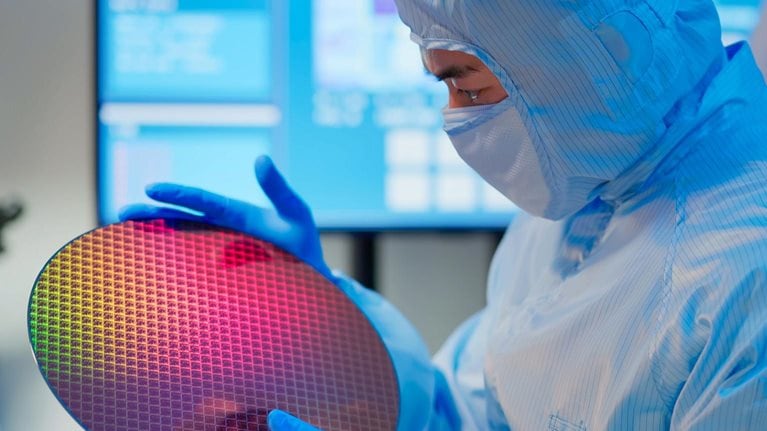

Thereby, Duc Giang Chemicals became one of the world’s largest exporters of yellow phosphorus, accounting for nearly 1/3 of the total amount of yellow phosphorus exported globally. Yellow phosphorus is an important input material, widely used in many industries such as fertilizers, pesticides, food, especially the production of electronic chips, semiconductors and lithium batteries.

Meanwhile, on the demand side, the Semiconductor Equipment and Materials International Society (SEMI) currently forecasts that global semiconductor sales this year will increase by 12% compared to 2023. Major chip manufacturers in the world are also being kept stable.

Notably, the average sales in the last 3 months of Taiwan Semiconductor Manufacturing Corporation (TSMC) continued to recover in December 2023 – nearly reaching the record high of 2022. TSMC is currently the manufacturer The world’s largest chip manufacturer. These signals are strengthening the recovery prospects of the global semiconductor industry, leading to the prospect of growth in industrial phosphorus demand in the coming months.

In addition, Duc Giang Chemical’s business activities also expect to benefit from multinational corporations implementing the “China + 1” policy in the supply of input materials, instead of depending on foreign suppliers. supplier in China.

Actual data shows that Duc Giang Chemical’s total industrial phosphorus (IPC) consumption in Southeast Asia and the US market in 2023 has doubled despite the weak global demand context. Currently, many US businesses or production facilities in Southeast Asia are promoting diversification of supply sources outside of China.

Trading volume and price trend of DGC shares of Duc Giang Chemical from the beginning of 2023 to present. (Source: TradingView)

See more: “Electric vehicle batteries – Long-term growth story of Duc Giang Chemical (DGC)” on Industry and Trade Magazine here.

In 2023, Duc Giang Chemical’s total IPC consumption output will reach more than 57,400 tons; Of which, in the fourth quarter of 2023 alone, consumption output reached 15,000 tons.

Vietcap Securities currently forecasts that this year’s IPC consumption volume of Duc Giang Chemical will grow by 20%, reaching nearly 69,000 tons. At the same time, the average IPC selling price this year will reach 4,300 USD/ton, an increase of 10.2% compared to the average price of the fourth quarter of 2023.

According to the leadership of Duc Giang Chemical, a number of new electric vehicle chip and battery factories being built in Japan, Korea and North America have expressed interest in purchasing phosphorus products. of the company. It is expected that by the end of 2024, Vietnam’s demand for phosphorus will increase dramatically when this series of plants comes into operation.

Duc Giang Chemical’s leadership also forecasts that India’s IPC demand in the first quarter of 2024 will improve after a significant decrease in the fourth quarter of 2023.

On the stock market, ending February 27, the market price of DGC stock reached 111,600 VND/share, approaching the historic peak. In just the past 20 trading sessions, the market price of this stock has increased more than 23%, becoming one of the stocks with the strongest increase on the market.

According to www.tapchicongthuong.vn